do nonprofits pay taxes on utilities

However it is a commonly. Property TaxRent Rebate Status.

For assistance please contact any of the following Hodgson.

. The underlying items are taxable or not based on existing state law whether the non-profit vendor is obligated to collect or not. In most states nonprofits are also responsible for paying the sales tax or using a tax on their purchases and charging the sales tax on their sold items. Pennsylvania Department of Revenue Tax Types Sales.

But nonprofits still have to pay. Wheres My Income Tax Refund. August 15 2018 Determining when to include rental income in your unrelated business income UBI tax calculation can be challenging.

While utilities used for residential purposes are. Common areas are excluded from the calculation because they are areas which are used for both residential and non-residential purposes. Those states that provide.

For merchandise Tangible Personal Property TPP rules apply. Your recognition as a 501 c 3 organization exempts you from federal income tax. Most nonprofits do not have to pay federal or state income taxes.

While most states wont require nonprofit. However if those members are. Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas.

A qualifying non-profit organization pays no sales tax on the electricity use. Again it is highly recommended that you seek the assistance of a tax professional before utilizing either form. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax.

The Illinois Department of Revenue has issued guidance to a taxpayer regarding exemptions for nonprofit. If those members are actively involved in the organizations exempt purpose then the organization pays no taxes on the income derived from dues. The user fee for Form.

Any nonprofit that hires employees will also need to pay employee taxes like Social Security Medicare and in some cases Unemployment Taxes. Exempt Organizations Liable for Excise Taxes on Utilities in Illinois. 2 Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com Do Nonprofits Or.

According to the Michigan tax code at the time of publication churches schools charities eligible hospitals. Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility. The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation.

State sales tax exemption on utility bills Revenue Administrative ulletin 1995-3. DLC must have a copy of the Pennsylvania Sales Tax Exemption certificate and the. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the.

House Bill 582 which legislates the tax exemption. Yes nonprofits must pay federal and state payroll taxes. However here are some factors to consider when determining what taxes a nonprofit may.

Do nonprofits pay taxes on utilities Wednesday June 1 2022 Edit. You also need to pay user fees when you file the forms.

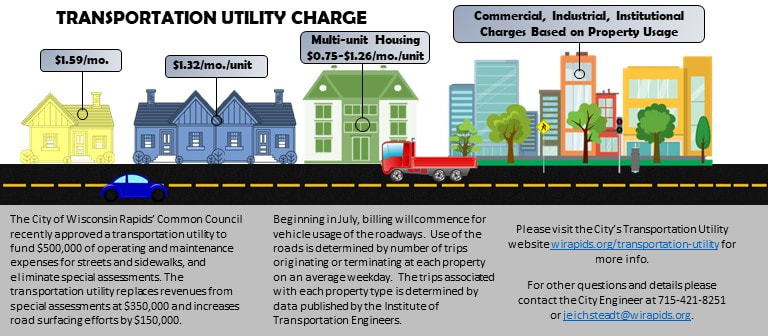

Transportation Utility City Of Wisconsin Rapids

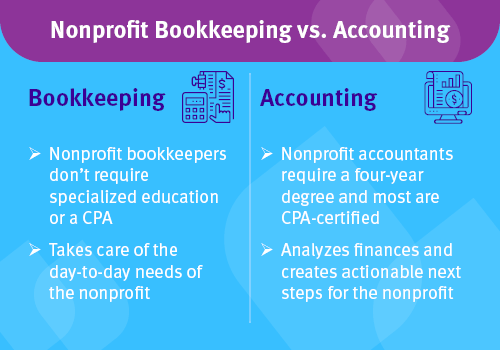

Nonprofit Bookkeeper Vs Accountant Who Should You Hire Jitasa Group

How And Why You Should Allocate Nonprofit Expenses

Myths About Nonprofits National Council Of Nonprofits

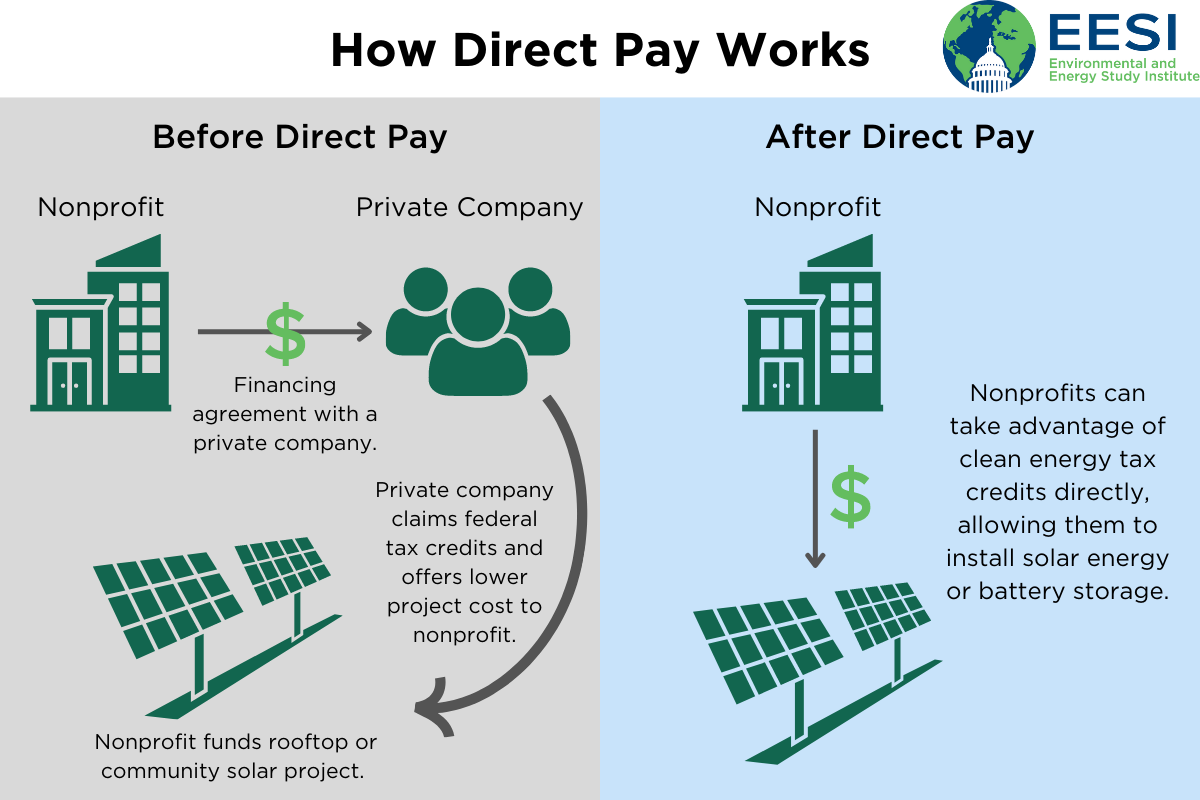

Rural Electric Co Ops See Benefits In Inflation Reduction Act

How Nonprofits Can Apply For Loans And Other Emergency Benefits

Sales Tax Considerations For Nonprofits

Misappropriating Nonprofit Funds A Look At Restricted Donations

Nonprofit Budgets A Quick Guide Best Practices Getting Attention

Understanding Nonprofit Payroll A No Stress Guide

List Of Nonprofits Accepting Bitcoin Crypto Donations The Giving Block

Clean Energy Tax Credits Get A Boost In New Climate Law Article Eesi

Why Utilities Are Lining Up Behind The Climate Bill E E News

Transportation Utility City Of Wisconsin Rapids

Setting Up A Charity Foundation Nonprofit Start Up Services A2z Filings

More Than 30 New Services Will Soon Be Subject To Sales And Use Tax

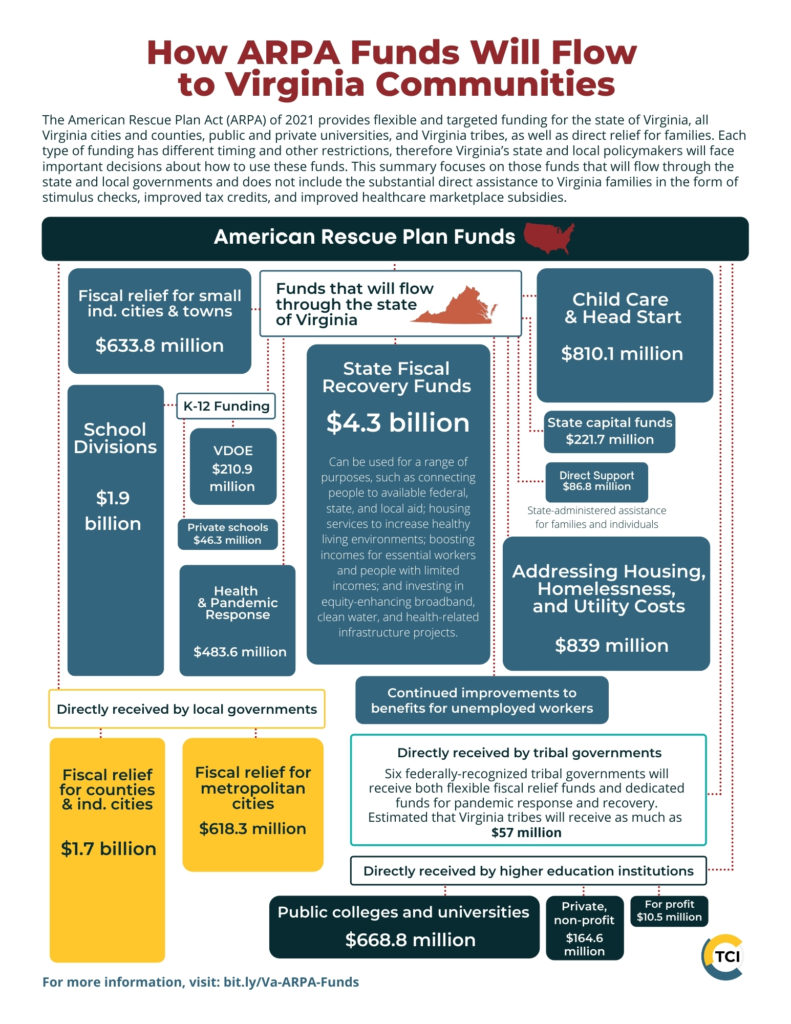

Use Of Arpa Funds A Step Forward More To Be Done To Build A Just Future The Commonwealth Institute The Commonwealth Institute